Note to Readers:

This is the first in a series of articles we’ll be publishing in the next two months on MarketGrader’s perspective on the equity markets of Europe’s developed economies. This first installment discusses the overall opportunity set for investors interested in European developed equity markets, focusing on the total number of companies in the region, their overall size relative to global equity markets and their breakdown by country. Future installments of the series will look more closely at the possible reasons European markets have failed to keep pace with other developed markets, and the sources of the economic malaise that has plagued many of Europe’s most advanced economies. We will then look closely at the investment opportunities in the region’s markets, where we’ll show that with a rigorous and consistent stock selection methodology investors may indeed find opportunities for high growth and significant capital appreciation.

Europe’s Markets in a Global Context

MarketGrader’s research covered 5,226 public companies across the equity markets of the 25 countries in Europe designated as developed economies by the International Monetary Fund at the end of 2020. Their aggregate market capitalization, which totaled USD 21.8 trillion, represented almost 22% of the USD 100 trillion in total global market capitalization at the time and was second only to the United States, which accounted for a little more than 40% of the world’s market cap. China’s combined equity markets came in third with a share of 16% of total global market capitalization. In sum, these three markets combined accounted for more than 75% of the global equity investment opportunity set.

With one in every five global market capitalization monetary units allocated to companies within developed markets in Europe, the region represents a significant capital allocation opportunity for investors worldwide. Furthermore, MarketGrader’s research shows that the developed Europe equity opportunity set is not only a complement to the world’s two other major equity opportunities – the US and China – but is also a significant diversifier, which we’ll discuss later.

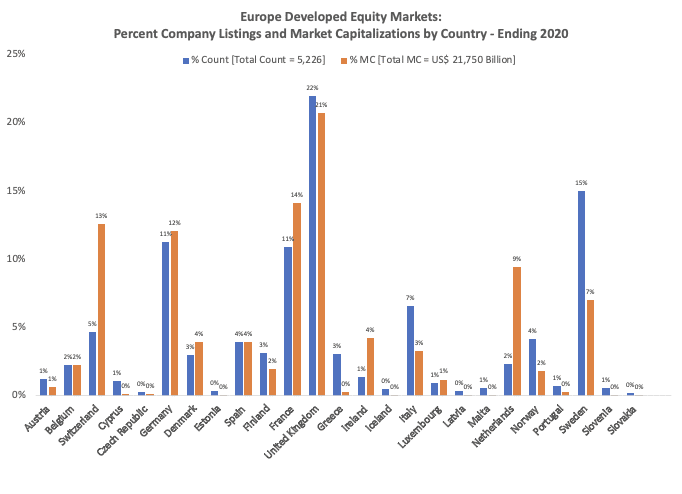

To assist investors in further understanding the attributes of this opportunity, it is helpful to take a deeper dive into the make-up of the developed Europe region. Figure 1 presents the country breakdown by listed company count and market capitalization of the region at the end of 2020.

Figure 1. Europe Developed Markets: Equity Listings Composition by Country – 2020

At the close of 2020, of the 25 economies representing developed Europe, only four had a percent share in the double digits in terms of the publicly listed companies domiciled on their shores. Of the 5,226 companies listed, the UK, with 1,149 companies, was the largest contributor with about 22% of the total listings. It was followed—somewhat surprisingly—by Sweden, which contributed 783 listings, or about 15% of the region’s total. The other double-digit contributors were Germany and France with 589 and 570 listings respectively, or about 11% of the European total each. These four markets contributed a combined 3,091 listings, or about of 60% of all listings across developed Europe’s equity markets. Put another way, a portfolio of 100 randomly selected stocks from the region would include about 60 companies from the UK, Germany France and Sweden and only about 40 companies from the remaining 21 developed economies.

From the perspective of market capitalization, the region had six markets with aggregate market caps in excess of USD 1 trillion. These are presented in Figure 2 relative to the aggregate market cap of the remaining 19 markets in the region.

Figure 2. Europe Developed Markets: Top Six Market Capitalizations

The UK, which ranked first based on number of companies listed, is also the largest market in terms of market cap, and by a wide margin. Yet, while its total listed companies accounted for 22% of the region’s total, their aggregate market cap of USD 4.5 trillion accounted for 20.7% of its total market cap. The UK is followed by France, with a total market cap of USD 3.1 trillion (14.1%) and Switzerland, with a whopping USD 2.7 trillion despite having only 245 listings, or 5% of total listings across developed Europe. So, unlike the UK, which has a fairly large number of smaller companies, Switzerland has a significant number of very large financial and pharmaceutical multinationals domiciled in the country. Germany follows, with a total market cap of USD 2.6 trillion (12.1% of the total), while the Netherlands comes in fifth with a total market cap of USD 2.1 trillion (9.4% of the total), despite having only 120 listings, or 3% of the region’s total. Sweden, which comes in sixth place, has 15% of the region’s total listings, or 783, yet only 7% of total market cap, or USD 1.5 trillion. Though on average the Swedish companies are smaller than those from the region’s five largest markets, the large number of them speaks to the country’s strong culture of entrepreneurship and the important role played by its capital markets in the Swedish economy.

The equity markets of the remaining 19 developed economies in Europe have a total market cap of USD 5.2 trillion, or 24% of the region’s total market cap. This means that if investors use a market cap weighted approach to gain exposure to developed Europe, a little more than 75% of the portfolio would be allocated to the UK, Switzerland, France, Germany, the Netherlands and Sweden.

Growth 2007 – 2020

The distributions of listings and market cap presented above are a single snapshot of the equity market for developed Europe taken at the end of 2020. MarketGrader’s coverage of European equity markets dates back to 2007, making it possible to compare the current market to the one from 13 years ago, even though some of the economies considered developed today may have not been considered developed then. Figure 3 presents the 2007 year-end snapshot for the 25 same economies that currently comprise developed Europe and compares it to the 2020 year-end snapshot described in the previous section. The percent changes reflect a period of 13 years (2008 through 2020) and can be thought of as the change net of new listings, bankruptcies and de-listings, mergers and spin-offs and in the case of market cap, organic changes in the share prices.

The aggregate changes in net listings and net market capitalization provide two somewhat different pictures of the region: whereas the change in listings suggest a relatively healthy equity market, the change in market capitalizations suggests a market that is stagnating and experiencing very little growth. More specifically, total listings grew from 4,252 at the end of 2007 to 5,226 at the end of 2008 – a net increase of 974 companies, or an average of 75 new listings a year over the past 13 years. While such increase in listings isn’t exactly vibrant, for developed economies this is an acceptable increase in listings and suggests the region as a whole is growing. But an increase in listings hasn’t translated to a significant increase in valuations, i.e., market capitalizations. Total market capitalizations have gone up from USD 16.5 trillion to USD 21.8 trillion – a cumulative growth of only 32% over a 13-year period. Put differently, the total change in market capitalizations including the increase in listings and increases in share prices was only 2.15% on an annualized basis over this 13-year period. This annualized rate of growth implies not only a dismal rate of return on a risky asset such as equities but also an extremely low risk premium for the asset class.

Figure 3. Developed Europe: Net Change in Listings and Market Capitalizations by Country, Start of 2008 Through 2020

| Listings | MC in USD Billions | |||||

| 2007 | 2020 | % Change | 2007 | 2020 | % Change | |

| Austria | 68 | 63 | -7% | $166 | $139 | -16% |

| Belgium | 106 | 118 | 11% | $270 | $481 | 79% |

| Switzerland | 216 | 245 | 13% | $1,448 | $2,735 | 89% |

| Cyprus | 15 | 54 | 260% | $7 | $24 | 217% |

| Czech Republic | 10 | 13 | 30% | $65 | $27 | -59% |

| Germany | 571 | 589 | 3% | $1,844 | $2,626 | 42% |

| Denmark | 137 | 154 | 12% | $431 | $854 | 98% |

| Estonia | 9 | 18 | 100% | $3 | $3 | 10% |

| Spain | 122 | 205 | 68% | $1,061 | $861 | -19% |

| Finland | 115 | 162 | 41% | $411 | $416 | 1% |

| France | 557 | 570 | 2% | $2,453 | $3,069 | 25% |

| United Kingdom | 1149 | 1149 | 0% | $4,395 | $4,512 | 3% |

| Greece | 185 | 161 | -13% | $220 | $53 | -76% |

| Ireland | 70 | 71 | 1% | $303 | $920 | 204% |

| Iceland | 5 | 24 | 380% | $1 | $16 | 1044% |

| Italy | 231 | 342 | 48% | $983 | $704 | -28% |

| Luxembourg | 28 | 48 | 71% | $354 | $256 | -28% |

| Latvia | 7 | 19 | 171% | $1 | $1 | 58% |

| Malta | 12 | 28 | 133% | $4 | $8 | 71% |

| Netherlands | 116 | 120 | 3% | $990 | $2,053 | 107% |

| Norway | 153 | 217 | 42% | $369 | $392 | 6% |

| Portugal | 43 | 36 | -16% | $119 | $61 | -49% |

| Sweden | 315 | 783 | 149% | $576 | $1,527 | 165% |

| Slovenia | 8 | 29 | 263% | $11 | $9 | -24% |

| Slovakia | 4 | 8 | 100% | $7 | $3 | -58% |

| Developed Europe | 4252 | 5226 | 23% | $16,492 | $21,750 | 32% |

We should point out, though, that the underlying 25 economies that make up the region experienced very different rates of growth in their equity markets and therefore averages can be misleading. From Figure 3 it is clear that the countries that experienced the biggest percent increase in listings are the smaller economies within Europe. With access to a bigger market and more sophisticated mean of raising capital, the equity markets of these smaller economies experienced a growth spurt after becoming a part of the European Union (much like the equity markets of emerging economies during globalization). Cyprus, Estonia, Iceland, Latvia, Malta, Slovenia and Slovakia are examples of such relatively small economies, all of which posted triple digit percent increases in their listings. The one exception is Sweden whose equity market was already relatively large with 315 listings and whose listings more than doubled to 783 publicly traded companies.

Notice that the larger equity markets such as those of Germany, France and the United Kingdom experienced marginal single digit percent increases in their listings indicating markets in equilibrium. But three markets – Austria, Greece and Portugal – experienced a net decline in the number of listings over the 13-year period ending 2020. The source of this decline was likely the 2008 global financial crisis.

In terms of market capitalization increases, five economies experienced triple digit percent increases. The two smallest markets with triple digit percent capitalization increases were Cyprus and Iceland, whose market caps increased by 214% and 1044%, respectively. They went from a combined market cap of USD 8 billion to USD 40 billion at the end of 2020. Ireland had the next largest increase, growing from USD 303 billion to USD 920 billion – a 204% rise. It was followed by Sweden, which went from USD 579 billion to USD 1.5 trillion – an increase of 165%. The Netherlands was the largest market with a triple digit percent increase, going from USD 990 billion to USD 2.1 trillion – an increase of 107%.

In addition to Austria, Greece and Portugal, whose markets experienced a decline both in listings and their total market capitalizations, another six markets experienced a net loss in market capitalizations but not in listings. These include the Czech Republic, Spain, Italy, Luxemburg, Slovenia and Slovakia. This means that a total of nine of the 25 economies within developed Europe experienced a market cap decline in their equity markets between the start of 2008 and the end of 2020.

Since the largest equity markets in terms of market cap are also the key drivers of market cap weighted investor portfolio, Figure 4 presents the change in the select group of markets with a market cap greater than USD 1 trillion in the past 13 years. Back at the start of 2008, Switzerland, Germany, Spain, France, and the U.K. were the markets within this select group. Combined, these five markets had an aggregate market cap USD 11.2 trillion, or 68% of the total developed Europe market cap.

In the ensuing 13 years Switzerland’s market grew by 89% while Germany and France had respectable gains of 42% and 25%, respectively, and the U.K. stayed flat with a marginal gain of 3% in its market cap. But the -19% decline in the market cap of Spain dropped its total capitalization from USD 1.1 trillion to USD 861 billion which means that it is no longer in the select group of markets with a market cap greater than USD 1 trillion.

Meanwhile, while Spain’s market fell out favor in the last 13 years, the Netherlands and Sweden grew significantly, with both of them ending 2020 with market caps greater than USD 1 trillion.

Finally, notice that excluding the past and present members of this select group of countries (greater than USD 1 trillion in market cap), the total market cap of the remaining 18 countries went from USD 3.7 to USD 4.4 – an increase of only 17%, suggesting that this group of countries played, and will continue to play, a small role in the performance of investor portfolios seeking exposure to developed Europe.

Figure 4. Developed Europe: Market Capitalization Countries Greater USD One Trillion, Starting 2008 Through 2020

| MC in USD Billions | |||

| 2007 | 2020 | % Change | |

| Switzerland | $1,448 | $2,735 | 89% |

| Germany | $1,844 | $2,626 | 42% |

| Spain | $1,061 | $861 | -19% |

| France | $2,453 | $3,069 | 25% |

| United Kingdom | $4,395 | $4,512 | 3% |

| Netherlands | $990 | $2,053 | 107% |

| Sweden | $576 | $1,527 | 165% |

| Others | $3,725 | $4,367 | 17% |

| Total | $16,492 | $21,750 | 32% |

The MarketGrader Scores©

MarketGrader Research publishes an MG Score for every publicly listed company in the developed Europe equity universe. The MG Score is calculated based on company specific fundamentals in four major financial categories: growth, value, profitability and cash flow. The goal of the MG Score, which is mapped into a “BUY”, “HOLD” or “SELL” rating, is to assist investors in stock selection for constructing portfolios with specific objectives such as those designed to give core or satellite exposure to a particular equity asset class.

Figure 5 presents MarketGrader’s ratings breakdown of the developed Europe equity universe. At the end of 2020, 507, or about 9.7% of the region’s 5,226 listings were rated as BUY. Another 676, or about 12.6% were rated as HOLD, and the remaining 4,063, or about 77.7% of the entire universe was rated as SELL.

Figure 5. MarketGrader Score: Developed Europe Equity Universe by Category

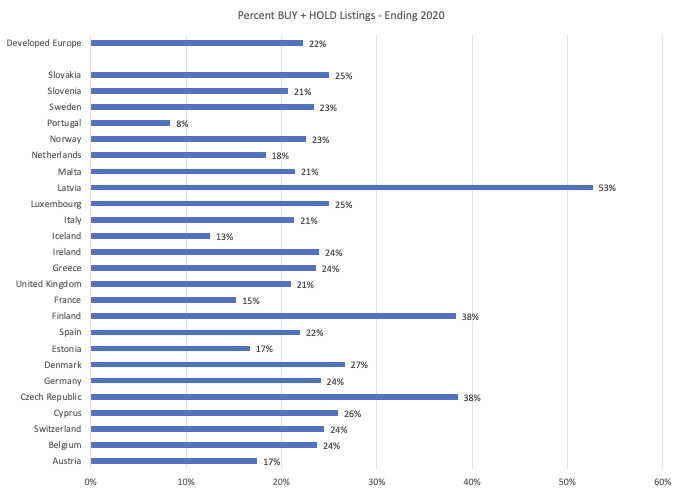

It goes without saying that the percentage of BUY+HOLD listings relative to the SELL listings differ significantly by country. Consequently Figure 6 presents the percentage of the total BUY+HOLD listings (rounded to the nearest percent) for each country.

Figure 5. MarketGrader Score: Percent BUY+HOLD Listings by Country Developed Europe Equity Universe Ending 2020

The next installment of the series will take a closer look at the historical returns of all equity markets among Europe’s developed economies in order to determine the greatest contributors to–and detractors from–capital appreciation in the region.